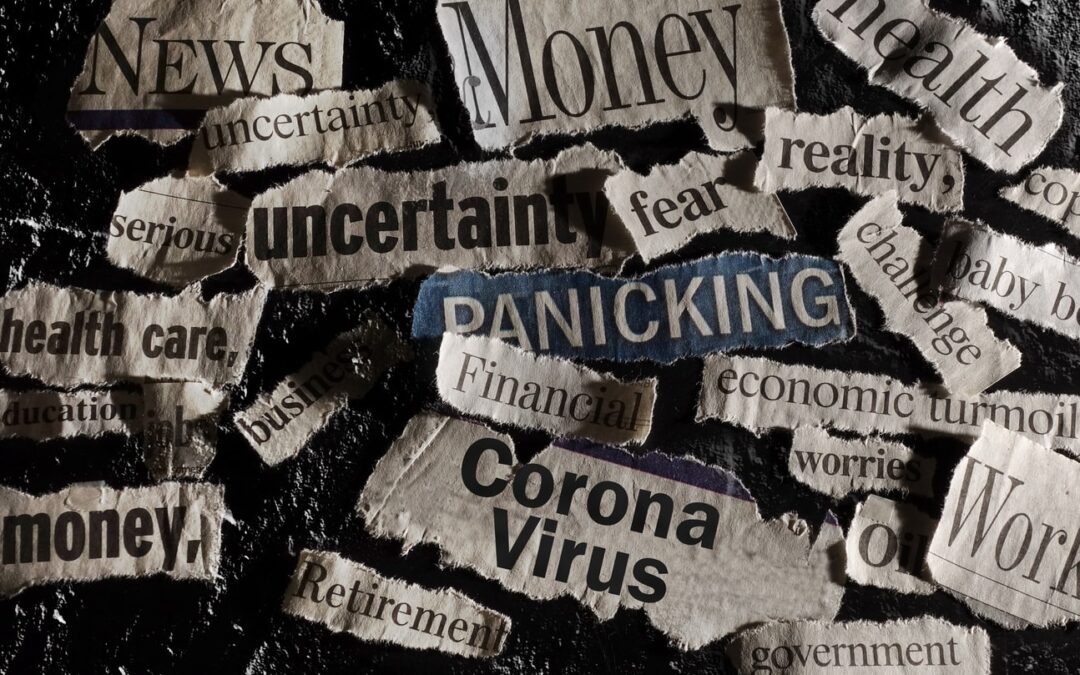

Fear as Currency: How Panic Cycles Drive Markets and Society

The Mechanics of Panic

Panic cycles are self-reinforcing loops of fear, reaction, and amplification. In markets, politics, or social media, one small trigger can snowball into widespread anxiety. People act impulsively, often overestimating risk, which fuels further panic in others.

These cycles are predictable, yet most individuals experience them as sudden, unavoidable crises — reacting rather than analyzing, trapped in a feedback loop of collective stress.

Economic Impact

Financial markets are particularly susceptible. Stock sell-offs, crypto crashes, and housing speculation often stem more from fear than fundamentals. Panic-driven decisions magnify volatility, disproportionately affecting those unprepared or overly reactive.

Social Amplification

Media, influencers, and online communities accelerate panic cycles. Algorithms favor engagement, which often means amplifying sensational or fear-inducing content. This creates a shared emotional environment where anxiety spreads faster than accurate information.

Psychological Levers

Panic exploits cognitive biases: loss aversion, herd behavior, and confirmation bias. Understanding these levers allows individuals to pause, reassess, and act strategically rather than impulsively. Emotional discipline becomes more valuable than immediate action.

Breaking the Cycle

The antidote is awareness and preparation. Recognize triggers, maintain reserves, and verify information before reacting. Systems, both financial and social, respond predictably to panic — anticipating patterns turns potential vulnerability into strategic advantage.

Panic cycles aren’t anomalies; they are recurring features of human systems. Mastery comes from observing, understanding, and responding deliberately, transforming fear into foresight instead of becoming a victim of collective anxiety.

:max_bytes(150000):strip_icc()/GettyImages-103057983-4ea56e613e704344937cd89f50c13cfa.jpg)

Comments

No comments yet, be the first submit yours below.